FLOODS AND CYCLONES IN TANJORE DISTRICT DURING 19th CENTURY

December 31, 2020IMPACT OF IMPLEMENTATION OF E-POS MACHINES IN RATION SHOPS – A CONCEPTUAL FRAMEWORK

December 31, 2020Sparkling International Journal of Multidisciplinary Research Studies

PERFORMANCE AND CONTRIBUTION TO RETAIL LENDING BY RETAIL ASSETS CENTRAL PROCESSING CENTRE, TRIVANDRUM-AN EVALUATIVE STUDY ON THE TOPIC

Kaveya. P

Research Scholar, Department of Economics, University of Kerala, Trivandrum, Kerala, India.

Abstract

Since inception in the year 1955 from the Imperial Bank of India to the State Bank of India, the Bank enjoys supremacy in contributing credit to all sectors of the economy thereby participating prominently in the economic development. The Bank’s Loan policy for domestic lending aims at a profit with growth based on proper credit risk analysis and adequate system and control. The Bank has come out with optimal exposure levels to various categories of borrowers as per prudential exposure norms prescribed by RBI. As a measure for effective implementation of achieving expected growth in personal segment portfolio, Business Process Re-Engineering (BPR) was formulated by the Bank. The main objectives of BPR were to enhance the customer service level. One of the main parts of this BPR initiative is the formation of Retail Assets Central Processing Centre called by RACPC which covers Personal Segment Loans namely Housing, Education, Car, Mortgager, Personal and Reverse Mortgage loans. RACPC, Trivandrum centre was opened on 20th May 2006 headed by the Assistant General Manager. In the early stages, it was looking into the migration.

Keywords: business process re-engineering, reserve bank of india, business process re-engineering, retail assets central processing centre, deputy general manager, memorandum of undertakings, assistant general manager.

Introduction

Under the COVID 19 situation of pandemic issues, our economy passes through a very bad situation with chronic distortions. To support and ensure achievement of expected growth, Banking sector deposits and credit are poised to grow in Tandem Bank credit is considered to be the key factor in economic growth and development in all nations and India is not an exception. It is generally agreed that countries with efficient credit system grow faster while inefficient credit system leads to Bank failure. The study of Bank Credit is presently very relevant as Banking Industry is all set to support the nation in achieving expected growth in national income. State Bank still stands as the best and trustable source of credit both for the people and of the nation. The Bank has come out with optimal exposure levels to various categories of borrowers as per prudential exposure norms prescribed by RBI. An ever-growing middle-class population and rising income levels, combined with the demographic change of smaller household sizes have boosted demand for retail credit. There may exist meaningful inter-linkages among economic indicators and personal finance growth such that the variation in retail credit at the macro level can be explained. Banks’ credit policies and processes are prepared with the broad risk management objective and the oversight of the credit policy remains with the senior management.

One of the main parts of this BPR initiative is the formation of Retail Assets Central Processing Centre called by RACPC which covers Personal Segment Loans namely Housing, Education, Car, Mortgager, Personal and Reverse Mortgage loans the loan applications are canvassed by the Linked Branches and Marketing teams and forwarded to this Centre for scrutiny and sanction. The loan applications are processed and sanctioned at RACPC. Every month on average it sanctions more than 400 proposals approximately amounting to Rs. 400 corers several strategies have been implemented by the Centre since inception to improve the business level and to achieve the expected growth in business. The number of linked Branches increase day by day as new Branches are getting opened at all major centres to effectively cater to the requirements of existing and new customers. The centre is considered to be one of the best in the country in terms of processing, sanction, and maintenance of loans, and with this rapid development and expansion proposed, the Centre is expected to reach a level of 6320 corers by the end of 2020. In this project paper, the activities by the Centre, formalities, requirements for retail credit, workflow, its achievements, future expectations and proposed expansions are Looked into and studied in detail to have a clear insight into this very new initiative by SB in increasing its exposure to retail lending thereby making its due contribution to the economy and in turn to nation-building

The objectives of the study

- To deal with the performance of RACPC Trivandrum

- To study about the BPR Initiative And Formation of RACPC

- To deal with the structure of RACPC

- To analyse the performance and achievements of the Unit

- To formulate ideas including provisions for the development and contribution of the centre for service sector development

BPR Initiative and Formation of RACPC

BPR initiatives have been undertaken by the Bank with the objective to “transform the Bank into a world-class financial institution by proactively reaching out to acquire a new high net worth customers, building deep and lasting relationships with existing customers, and providing all customers with the best quality of service across multiple channels. Centralized /regionalized processing ability to enhance the customer service levels and experience by guaranteeing shorter waiting times, shorter Interaction/processing times, and offering customers a wider range of products to choose from. It further ensures a reduction in transaction processing errors, reworks, and customer complaints through the creation of specialist teams at centres of Excellence. Retail Assets Central Processing Centres (RACPC) opened as part of the BPR initiative covers personal segment loans namely Car Loans, housing Loans, Education Loans, Mortgage Loans, Personal Loans, and Reverse Mortgage Loans. The loan applications will be canvassed by the identified Branches/Sales teams and Forwarded to RACPC. The loan applications are processed and sanctioned at the Centre. SBI could achieve very high business growth in retail lending out of this new Initiative.

- Education Loans: SB Education Loans have grown at 23.2% (as on March 2019). SBI has a total Exposure of Rs.12, 566 crores as on March 2019 and is the market leader with a market share of approximately 257.

- Personal Loans: The Personal Loans Portfolio, grew by Rs.3, 691 crores in FY’ 20.

- Auto Loans: SB Auto Loans maintains its market leadership in retail car loan financing and enjoys a market share of 17.9% as on March 2012. Real Estate Habitat and Housing Development (RE, H&HD): Home Loan portfolio of the Bank grew by Rs.12, 826 crores during F”Y 2019-20 to Rs. 1, 02,739 crores. Total Home Loan limits sanctioned during FY 2019-20 were Rs.28, 036cores. State Bank continues to be the No.1 Home Loan player in terms of size of the Individual home Loan portfolio – amongst all players in the home loan market.

RACPC at a Glance

Location: LMS Building, Palayam, Thiruvananthapuram

RACPC Formation – Pilot-.23.05.2006

(RASECC was linked to Core Banking Solutions and started documenting and disbursing retail assets)

RACPC headed by-Assistant General Manager

No of Branches linked to RACPC: 48 Branches linked to RACPC

Thiruvananthapuram -Thiruvananthapuram Branch

There are 48 branches linked to RACPC Thiruvananthapuram Branch. Thiruvanan thapuram Region and 8 Branches of Kollam Region. The distance of Farthest branches from RACPC being-SOUTH: Parasala- 35km, NORTH: Thattathumala-35km, WEST-Attingal- 30km

The following 48 Branches are linked to RACPC, Thiruvananthapuram for Processing, sanction and follow up of retail credits:

- Althara Junction Branch

- Attingal

- Balaramapuram

- CGO Complex, Poonkulam

- Chirayinkeezhu

- Civil Station, Thiruvananthapuram

- CommercialBranch,Thiruvananthapuram

- Fort Branch

- IILL Complex, Peroorkada

- Jawahar Nagar

- Kanjiramkulam

- Kannammoola

- Karamana

- Kattakada

- Kazhakuttam

- Kottukal

- Mangalapuram

- Mannanthala

- Marakada Road, Thiruvananthapuram

- Medical College, Thiruvananthapuram

- Nanthencode

- Nedumangad

- Neyyattinkara

- NRI Branch. Thiruvananthapuram

- Panavila

- Parassala

- Pattom

- Personal Banking Branch, Thiruvananthapuram

- Peyad

- Ponganadu

- Pothancode

- SIB, Thiruvananthapuram

- Specialized Personal Banking Branch, Thiruvananthapuram

- Sreekariyam

- Statue, ThiruvananthaPuram

- Technopark

- Techno valley

- Thampanoor

- Thattathumala

- Thembamoodu

- Thiruvananthapuram Main Branch

- Thumba

- Valiamala

- Valiyathura

- Valiyavila

- Vanchiyoor

- Vattiyoorkavu

- Venjaramoodu

Loan Origination Software: The first rollout of LOS in India was at RACPC Thiruvananthapuram. All retail loans except Mortgage, Reverse Mortgage, and Home Equity Loans are processed and sanctioned in LOS. Staff Strength as on 1ST December 2019. Officers (including AGM and concurrent auditor): 23, Subordinate Staff: 2, Clerical Staff: 12, TOTAL: 37.

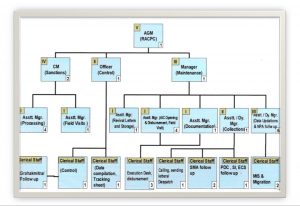

Table 1. Structure of Racpc Trivandrum

Role of the Retail Assets Central Progressing Center (Products covered by Retail assets Central Processing Center

*The products/services that are covered by the center of the Retail assets are as under:

- Housing loan.

- Car loan

- Education loan

- Mortgage loan

- Personal Loan

In addition to the above, loans to staff members are also handled by the centre.

Processes/sub-processes covered by a Retail asset Central Processing Centre

The Description of the processes/sub-processes covered is as under:

- Preparation of appraisal for all loan accounts (for products mentioned above)

- Pre-sanction and post-sanction I pre-disbursement inspections

- Sanctioning of all loan accounts (for products mentioned above)

- Documentation

- Disbursement for all loans sanctioned

- Account maintenance for all loans sanctioned which includes

- Formalities like insurance. Lien on Dematted Shares

- Obtaining Revival letter

- Change in EMI / Rate of Interest

- other maintenance activities

- Closure of account, the release of documents, and cancellation of loan Documents

Key operating / sub-operating entities Processing Centre within the Retail assets Central

Retail assets CPC will have the following operating/sub operating Entities

- AGM (RACPC)

- Control officer’s section

- Loan Account Processing and Sanction

- Loan account maintenance section

The Generic layout of the Retail assets Central Processing Center

The following guidelines have been followed for designing the

- The inward should be easily accessible and should be located, near the entrance.

- Flow of paper should be only in one direction

Detailed Role of RACPC Functionaries

Role of AGM (RACPC)

- Overall administration in charge.

- Sanctioning of proposals even those that may fall under delegated financial powers of sanctioning officers, upon processing and recommendations of the manager /chief manager.

- Supervising all activities of the RACPC, including operations of the credit processing section and maintenance sections.

- Ensuring adherence to turn around and process discipline as layout in-process manual.

- Ensuring efficiency (% of proposals processed on time) (benchmark -99%) and productivity. (number of people required for processing)

- Sending control reports to the controller and signing control reports for Proposals sanctioned by sanctioning officers.

- Arranging for appropriate staffing and infrastructure, whenever required.

- Reporting performance of the CPC to operations organization on a Regular basis.

- Ensuring regular enforcement of Service Level Agreements entered into with external service providers (like advocates, values, couriers).

- Providing suggestions to the CPC controller for better performance of the RACPC.

- Ensuring that all reports are scrutinized and acted upon by the responsible functionary at the CPC.

- Making efforts to develop subordinate staff by ensuring regular Training, providing on-the-job feedback, and upskilling.

- Ensuring prompt resolution of grievances and complaints.

Activities of AGM

- Sanction of loans that fall within his discretionary powers. According to the volume of proposals, considering the load balancing he should.

- Process and sanction the proposals even if they fall within the discretionary powers of the Chief Manager (Sanction & Processing) so that the sanction turnaround time is strictly maintained. However, such proposals should have been processed/recommended by the Manager/Chief Manager (Sanction).

- Ensure scrutiny of report and action taken, therefore.

- Ensure scrutiny of insurance renewal report and action taken, therefore.

- Ensure scrutiny of document revival report and action taken, therefore.

- Ensure meticulously the Time and Activity Discipline laid down by the Bank.

- Custody of the documents like stamped MOUs with valuers and advocates duly executed by them after entering them in the Branch Documents Register.

- Custody of the documents like Process manuals and Role manuals after entering them in the Branch Documents Register

- Evaluate the performance of each of the staff in RACPC in the Performance Metrics and ensure SLAs with other bank entities are being met.

- Take corrective action on the performance deficiencies in processing, Sanctioning and inspection, and other maintenance officers.

- Ensure prompt resolution of grievances that are logged at the RACPC either from branches, outbound salesforce, or customers.

- Coordination among branches/OSF I Zonal office/Local Head Office For the purpose of number and quality of loan proposals and other Performance issues.

- Ensure maintenance, balancing and, reconciliation of various office Accounts as under:

- RACPC Processing Charges Collection account

- RACPC Advocates’ Fees Collection account

- RACPC Value’s’ Fees Collection account

- RACPC Stamp Charges Collection account

- RACPC Stamp account

- Operating account of RACPC opened for daily expenses ‘Payment of staff bills, etc.

- Arrange for the availability of necessary resources and inputs for the RACPC after discussions with his sectional heads.

- Check the important reports generated by the system and ensure that the laid down systems and procedures are followed in the best interest of the Bank

- Ensure timely reporting of important business and operational Matters to the module DGM and initiate appropriate corrective Measures well in time.

- Arrange for the training of staff for improving their skills and knowledge from time to time.

- Prepare and submit reports as stipulated to module DGM.

- Attend to any other work entrusted to him by module DGM relating to the RACPC.

Key Performance Metrics for the AGM (RACPC)

- Individual productivity of sanctioning at least 5 proposals a day.

- Of proposals getting disposed at the CPC within (benchmark – 99%).

- Productivity per staff at the (benchmark – e.g. 45 proposals processed per Credit officer per month; more benchmarks in individual role descriptions).

- Time barred documents or uninsured assets at RACPC.

- % of accounts becoming doubtful.

- Total cost per proposal processed and accounts maintained (as low as possible).

- Rating (as given by inspection and audit department – as high as possible).

- Adherence to process discipline and controls, as specified in time and Activity discipline and in the process manual and the bank’s Book of Instructions.

- Minimum number of entries outstanding beyond a week in all the office Collection and withdrawal accounts.

Role of the Control Officer

- Responsible for maintenance of the RACPC premises and monitoring security arrangements thereat.

- Meeting, negotiating, selecting, and finalizing contracts with all service providers AMCs for machineries/ equipment and enforcement/renewal of AMC.

- Maintenance of IT hardware and software within the RACPC Includes ensuring disaster recovery plans, data backups and troubleshooting.

Activities of Control officer

- To implement and ensure Time and Activity Discipline in RACPC as Prescribed by the Bank – this would include monitoring for each vendor and intervening where necessary e.g. if there is a search Report that is due for a particular day but has not been returned, the Control officer should contact the advocate concerned and demand that the report be delivered on time.

- Monitor receipt of legal and valuation reports and their internal Movement in RACPC.

- Oversee regular, trouble-free availability of all maintenance services Electricity, water supply, cleaning the premises, pantry, etc) within (The premises).

- Oversee regular maintenance of premises (painting, repairs, etc).

- Oversee security arrangements at the premises for RACPC property as well as safety of staff.

- Purchases and accounting of all expenditure undertaken to the RACPC including payments to service providers, purchase of Equipment, dispensation of compensation, reimbursement of Expenditures and any other expenditure

- Renewal of AMCs of various machines, PCs, equipment’s, etc.

- Inward desk and dispatches.

Reporting relationship to be followed by the Control officer

- The Control officer reports directly to the AGM (RACPC).

- In addition, the Control officer interacts on an informal basis with other Functionaries at the RACPC.

Skills required for the Control officer

- Good knowledge of purchases of equipment’s, stationery, premises, etc.

- Knowledge of time and activity discipline in RACPC.

Key Performance Metrics of Control Officer

Balancing and reconciliation of 3 collection accounts as above and one Office withdrawal account.

Role of chief Manager (sanctions)/ Manager (sanctions)

Overall in charge of sanction portfolio of RACPC

Activities of Chief Manager (Sanctions)/Manager (Sanctions)

- Implementation of Time and Activity Discipline prescribed by the bank.

- Sanction within the powers delegated to him retail credit proposals put Up to him for sanction.

- Put up the loan proposals sanctioned by him to higher authority i.e. AGM (RACPC) for control.

- Process / appraise and recommend for sanction by AGM / Higher up the retail credit proposals which are beyond his discretionary powers and put up to AGM (RACPC) for sanction.

- Scrutinize the following special exception reports:

- Processing and sanctioning delay report

- Proposals in respect of which referral (recommendation) is made,

- However not sanctioned in the loan tracking by the appropriate Authority.

- Proposals sanctioned, referred for control in the loan tracking but not noted.

- In the event of sudden incapacitation or absence on account of leave or Deputation for training of head of RACPC, Chief Manager Sanctions), if he is a Scale IV official will officiate as head of RACPC and exercise the financial powers with the prior approval of Controlling Authority. However, in case Chief Manager (Sanctions) is Scale III official, proper relief arrangements should be made by the Controlling Authority.

- Support to AGM (RACPC) in attending to inspection and audit Reports for matters related to Sanctions.

- Monitor the performance of credit processing teams attached with Him, on an ongoing basis, and provide them guidance and arrange for their training in the requisite area.

- Evaluate the performance of the credit sanction team on agreed Processing times, turnaround times and Performance metrics.

- Ensure prompt resolution / redressed of grievances. either from Branches, outbound sales persons or customers related to processing /Sanction of Proposals.

- Report periodically to the AGM (RACPC) the performance of external Service providers / agencies attached to the RACPC like the valuation Agency, advocate panel, couriers, etc

- Arrange for training of staff for sharpening their skills and knowledge From time to time.

- Prepare and submit reports as stipulated to the AGM (RACPC).

- Attend to any other work entrusted to him by AGM (RACPC) relating to his section.

Role of chief manager (maintenance)

The Chief Manager (Maintenance) is the overall in-charge of the Following sections at the retail asset CPC

- Loan account opening and disbursement

- Documentation

- Collections (PDC handling, issue of statement of account’ Telecalling, revival letters, insurance renewal, etc’)

- Storage of security documents

Activities of the Chief Manager (Maintenance)

- Ensure that all the activities of maintenance of retail loans with respect to the setup account setup, customer setup, scanning of signature (for new loan accounts) execution of documents and disbursal of the loan amount to the customer, and further maintenance like renewal of insurance, handling, revival of documents, cancellation of documents, etc. (this list is illustrative and not exhaustive) are carried out within the benchmark turnaround time.

- Ensure that all the maintenance-related reports as per Annexure I are generated through CBS and acted upon by the concerned Sectional Head.

- Scrutiny of PDC failed report and action taken, therefore.

- Scrutiny of S.L failed and Check off failed and follow up therefore

- Ensure timely/prompt disbursement of loans/loan installments based on findings recorded in the pre-disbursement inspection reports

- ensure that efforts are made for soft recover through telecalling, Sending letters/reminders, visits to customer and issue of letters giving Warning of N.I. Act proceedings where warranted

- Ensure follow up of confirmation for creation of equitable mortgage (Also, applicable to Equitable Mortgage done at a centre other than at RACPC centre).

- Scrutiny of insurance renewal report and action taken therefore.

- Scrutiny of document revival report and action taken therefore.

- Ensure meticulously the Time and Activity Discipline laid down by the Bank.

- Ensure that WR (Voucher verification report) and other day end Reports are properly checked by the concerned officials.

- Ensure maintenance and balancing of various Office accounts as under

- RACPC Stamp Charges Collection account

- RACPC Stamp account

- Ensure timely and connect document execution.

- Supervise custody

- Supervise replenishment

- Pass necessary vouchers

- Issue for bankers cheque / draft for disbursement and follow up for acknowledgement therefore.

- Supervision of RTO formalities

- Custody of documents

- Revival of documents

- Insurance renewals, listing, daily list

- Custody of files

- Processing charges – payment of service tax

- Filing of returns with the appropriate government authority for Service tax and

- Ensure the MIS section generates and delivers to the appropriate authority, stipulated reports on specified dates and within laid down Deadlines.

- Report to the AGM (RACPC) the performance of external agencies attached to the loan account opening section e.g. suppliers of the scanning machineries so that all the facilities are available in trouble free manner for rendering excellent service.

- Any other work entrusted to him by his superior related to this section Reporting relationship to be followed by the chief Manager at stipulated periodicity.

Achievements of the Centre

Housing Loans

- Housing loans are generally granted to purchase/construct a new/old house (Including- repair and renovation) or flat or plot for construction/furnishing/ purchase of consumer durables.

- Individuals including non-resident Indians/persons of Indian origin over 21 years of age with a steady source of income are eligible for finance.

- Age, steady source of income of the applicant, and absolute and marketable title by the applicant over the property are the major requirements to be eligible for finance under the scheme.

- For outright purchases interim security is insisted upon till the time the documents relating to the property/ house/flat purchased are received by the Bank and equitable mortgage created thereon.

- But where there are tie-up arrangements especially in the case-of builders Constructing villas and flats, no interim security is insisted; instead a tripartite Agreement between the Banks. Builder and purchaser serves the purpose’ State bank continues to be no 1 home loan players in terms of size of the individual home loan portfolio amongst all players in the home loan market and RACPC, Trivandrum plays an important role for home loan finance in & around Trivandrum contributing substantially to the achievement of maximum market share by the bank in home loans in Kerala.

Loans and RACPC

Auto Loan

- Auto loans in retail lending mainly cover loans for the purchase of new and used cars not more than 3 years old. Individuals with a steady source of income are eligible for finance. The scheme covers all makes of cars though subvention amount will be available only for Maruti and Telco cars.

- SB auto loans maintains its market leadership in retail car loan financing and Enjoys a market share of 27.51% as on March 2019. RACPC Trivandrum contributes its due share by being the best performer in car loan financing in Kerala.

Educational Loans

Education loans are granted to Indian Nationals for pursuing studies at colleges and reputed institutions. No collateral is insisted up to 4 lacs and loans beyond 4 lacs require security of land, valuables or third party guarantee worth the sanctioned amount. Expenses related to private stay, purchase of computer, two-wheeler, and EDU-shield policy.

Staff Loans

Loans generally granted to staff include housing loans, vehicle loans, and, computer Loans, consumer loans and personal loans. No target is set for staff loans and loan under this category carries special interest rates, applicable to staff member so which are generally lower or equal to the rates offered by the Bank to retail borrowers. The main reason is that large numbers of officers and staff were availed by retired employees. Upper limits for various loans including housing loans underwent considerable changes resulting in the increase in the quantum of loans which the employees utilized for various needs. This resulted in the increase in levels even though the number declined in absolute term recruited and the loans, availed by the new recruits surpassed the closure of Loan.

Expectations of the Centre

The Centre expects to achieve the level of Rs. 98000 lacs in Home loans and Rs. 11000 lacs in Auto loans Rs. 11000lacs in Education loans, Rs. 1500 lacs in Mortgage loans and Rs. 6500lacs in personal loans by the end of March 2019.

Conclusion

This study of Bank credit especially retail credits is presently very relevant as Banking Industry is all set to support the nation in achieving expected growth in National income. In the present global scenario, India will need to guard against Volatile capital flows and built, up of asset bubbles’ Banking industry in the country has been undergoing so many changes, several new initiatives have been introduced with the intention to boost up the economy of the country and State Bank of India has played its role very well to the expectations in flow of credit to the economy’ State Bank of India, tire country’s largest bank still stands as the best and trustable source of credit both for the people of the nation and for the Government ‘since inception in the year 1955 from Imperial Bank of India to state Bank of India’ the Bank still enjoy ,supremacy in contributing credit to all sectors of the economy thereby participating prominently in the economic development of the nation’ State Bank of India still holds prime position in the country in retail finance especially in the Home Loan portfolio with a market share of 26 % besides maintaining its retail market leadership in car loan financing Centralized centres are opened by the Bank as a new business initiative to improve the total efficiency in retail lending and this central processing centre at Trivandrum is one of the largest processing centres of the Bank in the country in Terms of number of proposals and amount sanctioned’.

The methodology of the study consists of studying the workflow right from sourcing the applications to sanctioning and the maintenance of the retail assets of the Bank Primary data includes interactions with the officials at the Centre and also with the Officials at the controlling office to ensure a deep and clear study in the subject’ Publications named Annual Report of State Bank of India, Banking Journal and Data relating to the centre being presented every month to their controllers are also Referred for the collection of secondary data.

To conclude, this study attempted to examine the contribution of the centralized Processing centre of SB in promoting personal finance and thereby making its due contribution to the retail lending portfolio of the Bank to enable to retain its Supremacy and lead position among all Banks in the country.

References

Banking Law and Practice. (2014). The Institute of Company Secretaries of India, ICSI House, 22, Institutional Area, Lodi Road, New Delhi. Retrieved From https://www.icsi.edu/media/webmodules/publications/9.1%20Banking%20Law%20-Professional.pdf

Businesstoday. (2020). Retrieved from https://www.businesstoday.in/companies/state-bank-of-india

Chakrabarti R. (2012). State Bank of India: The Opportunities and Challenges of Being a State-Owned Bank in India. In: Yi-chong X. (eds) The Political Economy of State-owned Enterprises in China and India. International Political Economy Series. Palgrave Macmillan, London. Retrieved from https://doi.org/10.1057/9781137271655_11

Economic Survey. 2019-2020.

Gregory Mankiw.,K., (2011). Macro Economics, Worthn publishers, Newyork.

Hal R Varian. (2010). Intermediate Micro Economics, First East West Publication, Delhi.

Karnika Gupta., Nancy Gulati., (2013). Examining Performance of State Bank of India-A Financial Analysis. Research Revolution. 1(2). Retrieved from https://www.academia.edu/42787245/Examining_Performance_of_State_Bank_of_India_A_Financial_Analysis

Misra and Puri. (2009). Indian Economy, Himalaya Publishing House, New Delhi

National Federation of State Bank of India Sc/St Employees. (2017). Retrieved from https://www.nationalfederationscst.com/

Ptyagi,B., (2011). Labour Economics And Social Welfare, Jai Prakash Nath and Co, Meerut.

Reserve Bank of India. Retrieved from https://en.wikipedia.org/wiki/Reserve_Bank_of_India

Robert H Frank, and Ben.S.Bernanke. (2007). Principles of Economics, New Delhi.

State Bank of India, Annual Reports. (2019-2020). Retrieved from https://www.sbi.co.in/documents/17826/35696/23062020_SBI+AR+2019-20+%28Time+16_3b11%29.pdf/a358b5ec-1d32-a093-d9ac13071fda9ff6?t=1592911831224

State Bank of India. (2020). Retrieved from. https://www.agx.in/case-studies/state-bank-of-india/

Uma Kapila. (2019-2020). Indian Economy Since Independence, Academic Foundation, New Delhi.

To cite this article

Kaveya.P. (2020). Performance and Contribution to Retail Lending by Retail Assets Central Processing Centre, Trivandrum-An Evaluative Study on the Topic. Sparkling International Journal of Multidisciplinary Research Studies, 3(4), 17-29.